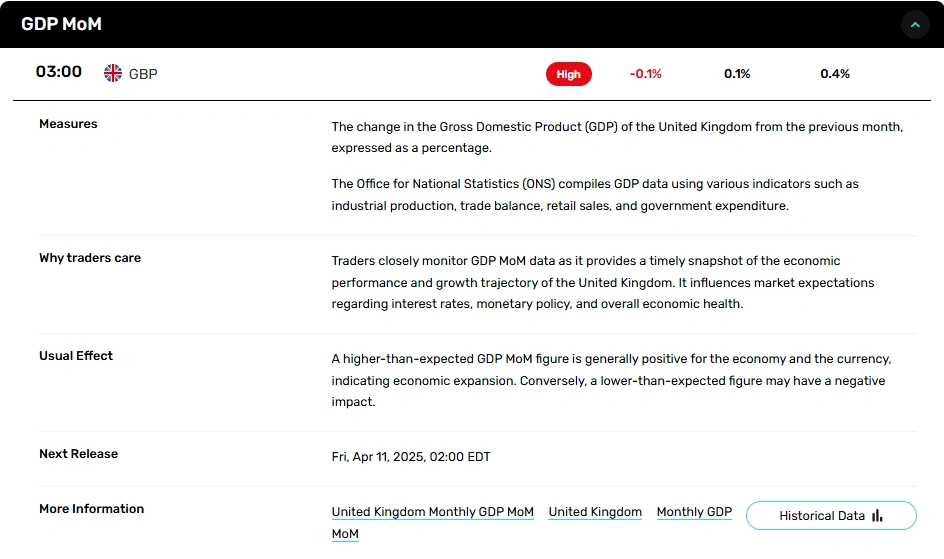

United Kingdom – The UK economy is once again showing signs of weakness, with GDP contracting by 0.1% in January. This reversal from December’s modest 0.4% growth not only missed economists’ expectations but also highlights the fragile state of the country’s economic recovery. With the Treasury’s Spring Budget looming, policymakers are under growing pressure to address the glaring cracks in their economic strategy.

The latest contraction is largely due to a faltering production sector, which failed to maintain momentum after December’s temporary gains. Meanwhile, the services sector, which is supposed to be the backbone of the UK economy, is barely staying afloat. The constant swings in monthly growth figures make one thing clear—this isn’t just a temporary slowdown, but a sign of deeper instability.

Despite the economic downturn, the Bank of England refuses to budge on interest rates. Inflation hit 3% in January, and the BoE is clinging to the idea that keeping rates high will somehow fix the problem. In reality, businesses and consumers are feeling the squeeze, and the central bank’s cautious approach may end up doing more harm than good.

As Treasury Chief Rachel Reeves prepares to present the Spring Statement on March 26, the government faces tough questions about its fiscal policies. Weaker GDP growth means lower tax revenues, leaving Reeves with little room to maneuver. The existing tax-heavy approach has already sparked concerns, with businesses fearing its impact on investment and hiring. Yet, the government continues to insist that raising taxes is the only way to fund public services.

Instead of fostering an environment for economic growth, the current strategy feels more like a short-term fix that could have long-term consequences. The balancing act between funding public services and maintaining business confidence is proving harder than officials anticipated.

The latest GDP figures confirm that the UK’s economic outlook remains fragile, and there’s no quick fix in sight. While the Bank of England remains reluctant to cut rates, prolonged stagnation could eventually force its hand. Traders and businesses will be watching inflation data, central bank signals, and fiscal policy shifts closely, as these will dictate market sentiment and the pound’s direction in the months ahead.

For now, the UK economy remains stuck in limbo—held back by indecisive policymakers and a lack of bold, forward-thinking leadership.